Landis+Gyr Announces First Half FY 2019 Financial Results

Zug, Switzerland – October 29, 2019 – Landis+Gyr (LAND.SW) today announced unaudited financial results for first half of financial year 2019 (April 1–September 30, 2019). Key highlights included:

- Net revenue reached USD 862.8 million, increasing 3.4% in constant currency

- Order intake was USD 818.9 million, a book to bill ratio of 0.95

- Committed backlog up 7.1% year-over-year to USD 2.51 billion

- Adjusted EBITDA up 16.9% to USD 124.9 million, a margin of 14.5%; includes one-off gain of USD 5.6 million resulting from a Brazilian VAT court case ruling (13.8% excluding the VAT court case ruling)

- Reported EBITDA of USD 128.2 million compared to USD 114.9 million in the prior year

- Both the EMEA and Asia Pacific regions experienced sales growth of 10.5% and 32.0% in constant currency respectively as well as Adjusted EBITDA margin expansion. The Americas posted resilient margins despite lower sales.

- Net income up 21.3% to USD 71.8 million or USD 2.45 per share

- Free Cash Flow, excluding M&A, USD 33.1 million

“Landis+Gyr’s results for the first half FY 2019 offer further evidence of our ongoing efforts to further strengthen the company’s market position and improve profitability. As expected, net revenue in the Americas experienced a decline due to project timing, while EMEA and Asia Pacific both delivered strong growth. These top line performances, coupled with continued cost control, translated to a 130-basis point improvement in the Group Adjusted EBITDA margin, excluding the impact from the Brazilian VAT court case ruling,” said Richard Mora, Landis+Gyr’s CEO.

Order Intake, Committed Backlog and Net Revenue

Order intake for H1 FY 2019 was USD 818.9 million, a decrease of 7.1% year-over-year in constant currency and equal to a book to bill ratio of 0.95. Committed backlog was up 7.1% year-over-year at USD 2,514.1 million. All regions reported increases in committed backlog compared to the prior year.

In H1 FY 2019, net revenue grew 3.4% year-over-year in constant currency, to USD 862.8 million.

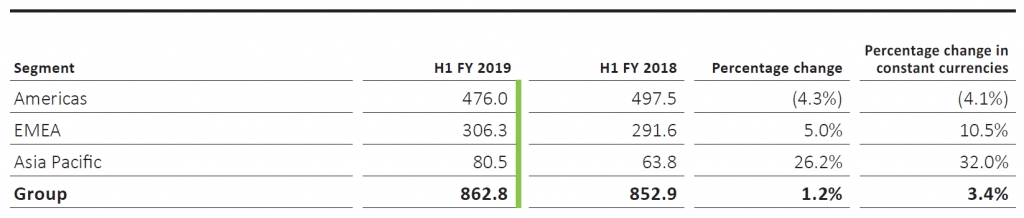

Net revenue to external customers per segment was as follows (in USD millions, except where indicated):

The Americas region delivered lower net revenue year-over-year, falling 4.3%, or 4.1% in constant currency, due to the timing of the roll off of two full-scale deployments previously underway in the US. The Americas’ committed order backlog grew by 7.4%, driven by new contract wins with Ameren,

Colorado Springs Utilities, PSEG Long Island and others.

Net revenue in the EMEA region was up compared to the prior year by 5.0%, or 10.5% in constant currency. Strong volumes in the UK drove the region’s first half performance, as destocking related to Brexit did not materialize. EMEAʼs committed order backlog stood at USD 790.2 million at the period end, up 3.9% year-over-year.

Asia Pacific likewise contributed to higher sales with year-over-year growth of 26.2%, or 32.0% in constant currency, as demand in Australia, Hong Kong and India drove the increase. Committed backlog was USD 89.0 million, up 36.7% compared to H1 FY 2018.

Adjusted and Reported EBITDA

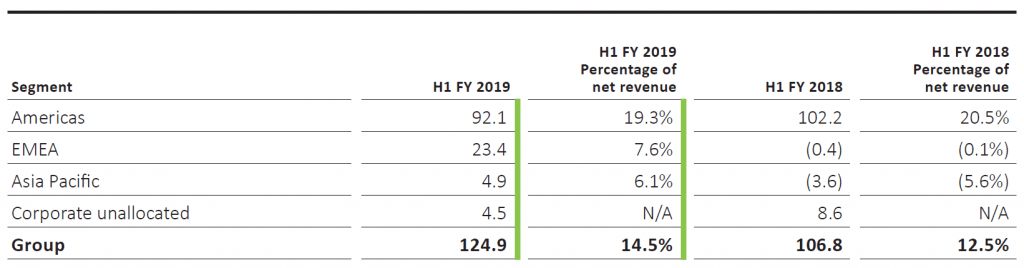

The Adjusted EBITDA by segment was as follows (in USD millions, except where indicated):

Overall, H1 FY 2019 Adjusted EBITDA margin increased to 14.5% from 12.5% in the prior year. H1 FY 2019 Adjusted EBITDA rose more significantly than sales, growing 16.9% year-over-year, coming in at USD 124.9 million, including the one-off positive impact from the Brazilian court VAT ruling of USD 5.6 million. Continued cost and efficiency improvements in EMEA and Asia Pacific more than offset a revenue driven decline in the Americas’ results, while lower incremental costs associated with eased supply chain constraints contributed USD 8.8 million to the Adjusted EBITDA improvement.

The one-off positive Americas’ adjusted EBITDA impact of USD 5.6 million comes from a recent decision by the Federal Court in Rio de Janeiro in a lawsuit between Landis+Gyr’s Brazilian subsidiary and the Brazilian tax authority that became final and non-appealable in September 2019. Based on this decision, Landis+Gyr is able to reclaim VAT payments made in prior years. The Company expects that this amount will be recovered over several years by means of an offset against future VAT payments due in Brazil. In addition, there is a further positive impact in interest income of USD 4.8 million in respect of accrued interest.

Project Lightfoot, aimed at bundling and partially outsourcing manufacturing activities to enhance production efficiencies, lower supply chain costs and further reduce capital intensity, is ahead of plan and is expected to deliver USD 20 million of annual savings in FY 2019. The Company expects a further USD 5 million of savings to be delivered next financial year, for total annual savings of USD 25 million in FY 2020

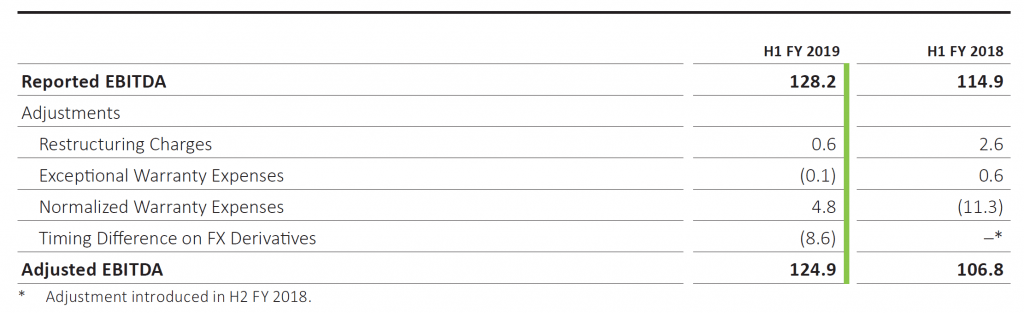

In H1 FY 2019, Operating income was USD 84.9 million, an increase of 25.6% from the USD 67.6 million achieved in H1 FY 2018. Reported EBITDA was USD 128.2 million versus USD 114.9 million in H1 FY 2018.

In H1 FY 2019, adjustments to bridge from Reported EBITDA to Adjusted EBITDA were in three primary categories. First, with respect to Restructuring Charges, the USD 0.6 million related to streamlining measures taken across the organization. Second, Normalized Warranty Expenses adjustment of USD 4.8 million represents the amount of provisions made relative to the average annualized actual warranty utilization for the last three years; H1 FY 2019 reported EBITDA included an increase to the legacy component provision of USD 11.3 million*. Thirdly, the Group introduced a new adjustment in H2 FY 2018, Timing Difference on FX Derivatives. In H1 FY 2019, this adjustment was USD (8.6) million. Hedges put in place by the Group experienced unrealized gains on a mark-to-market basis each month, primarily as a result of GBP exchange rate volatility.

The adjustments made to bridge between EBITDA as reported in the Group’s financial statements and

Adjusted EBITDA are as follows (in USD millions):

Net Income and EPS

Net income for H1 FY 2019 was USD 71.8 million, or USD 2.45 per share, and compares to USD 59.2 million, or USD 2.01 per share, for H1 FY 2018, an increase of 21.3% and 21.9% respectively.

Cash Flow and Net Debt

Cash provided by operating and investing activities was USD 33.1 million in H1 FY 2019 compared to USD (4.8) million in the prior year. H1 FY 2018 included a USD 18.9 million equity contribution cash outflow for the intelliHUB JV.

Free Cash Flow (excluding M&A) was USD 33.1 million in H1 FY 2019, an increase of USD 19.0 million compared to H1 FY 2018, as the seasonal pattern of a markedly lower Free Cash Flow (excluding M&A) in the financial year’s first half continued.

In H1 FY 2019, capital expenditure amounted to USD 12.7 million, below the H1 FY 2018 level of USD 16.9 million, consistent with the Company’s asset-light business model. As of September 30, 2019, the ratio of net debt to the trailing twelve month Adjusted EBITDA ratio was 0.4 times, with net debt USD 11.0 million lower year-over-year, even after the payment of USD 94.0 million in dividends and USD 20.3 million for share buyback during H1 FY 2019. The share buyback program is approximately 30% completed.

Guidance for FY 2019

“We remain positive on the balance of FY 2019, although regulatory delays could slow some project starts in the US. As a result, we have lowered our top line guidance somewhat. Our guidance for FY 2019 Adjusted EBITDA and Free Cash Flow (excluding M&A) remains unchanged,” Mora concluded. Landis+Gyr now expects FY 2019 net revenue growth of approximately 1–4% in constant currency, versus the earlier range of 2–5%. Group Adjusted EBITDA is expected to be between USD 240 million and USD 255 million. Free Cash Flow (excluding M&A) is expected to be between USD 120 million and USD 135 million, with a dividend payout of at least 75% of Free Cash Flow (excluding M&A).

Sustainability Report

Landis+Gyr’s FY 2018/19 Sustainability Report was issued today. In FY 2018, total CO2 emissions fell by 2.7%, and since measurement began of Landis+Gyr’s carbon footprint in 2007, CO2 emissions have been reduced on a per turnover basis by 32.4%. Total use of chemicals decreased by 10.7% and has fallen 50% over the past six years. Water consumption within the Group increased by 9.9% and total waste produced increased by 6.4%, being negatively impacted by weather conditions and one-time effects.

Recent Corporate Developments

- In North America, Colorado Springs Utilities will deploy the Gridstream® Connect platform connecting more than 590,000 electric, natural gas and water meters to an integrated network management and data acquisition system. The new contract provides for managed services by Landis+Gyr for a 20-year period, including deployment and post deployment services.

- In Sweden, Landis+Gyr will deliver its Gridstream® Connect solution for 1 million metering points to E.ON Sweden. With the contract, E.ON transitions to second generation Smart Metering technology for excellent customer service and grid efficiency.

- In the UK, the transition to the next generation smart meters (SMETS2) is since December 2018 underway in scale with more than 2.5 million SMETS2 meters on the network. As the UK market leader, Landis+Gyr has approximately 21 million meters deployed or under contract.

- Landis+Gyr has been awarded a new Software as a Service (SaaS) contract for the Smart Metering system of Liechtensteinische Kraftwerke (LKW), the public body that provides electric power to the principality of Liechtenstein. The contract expands an existing partnership with LKW, which has been using Landis+Gyr’s Advanced Metering Infrastructure (AMI) solution since 2011.

- Frost & Sullivan selected Landis+Gyr as their Global AMI Company of the Year for 2019. This is the fifth consecutive time the company has received the award.

Landis+Gyr Group’s Half Year Report 2019, the Sustainability Report 2018/2019 and the Half Year 2019 investor presentation were published today and can be downloaded at www.landisgyr.com/investors.

Investor Webcast and Telephone Conference

The management of Landis+Gyr hosted an investor/analyst call to discuss the company’s results. The playback can be downloaded at www.landisgyr.com/investors.

Contact

Stan March

Phone +1 678 258 1321

Stan.March@landisgyr.com

Christian Waelti

Phone +41 41 935 6331

Christian.Waelti@landisgyr.com

Key dates

| Capital Markets Day | January 27, 2020 |

| Release of Results for Financial Year 2019 | May 28, 2020 |

| Annual General Meeting 2020 | June 30, 2020 |

| Release of Half Year Results 2020 | October 28, 2020 |

* See note 13 in the Notes to Interim Consolidated Financial Statements for further details.

About Landis+Gyr

Landis+Gyr is the leading global provider of integrated energy management solutions for the utility sector. Offering one of the broadest portfolios, we deliver innovative and flexible solutions to help utilities solve their complex challenges in Smart Metering, Grid Edge Intelligence and Smart Infrastructure. With sales of USD 1.8 billion, Landis+Gyr employs approximately 6,000 people in over 30 countries across five continents, with the sole mission of helping the world manage energy better.

Disclaimer

This release contains information regarding alternative performance measures. Definitions of these measures and reconciliations between such measures and their USGAAP counterparts if not defined in this release may be found on pages 36 to 42 of the Landis+Gyr Half Year Report 2019 on our website at www.landisgyr.com/investors.

Forward-looking information

This press release includes forward-looking information and statements, including statements concerning the outlook for our businesses. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions, and the economic conditions of the regions and industries that are major markets for Landis+Gyr Group AG. These expectations, estimates and projections are generally identifiable by statements containing words such as “expects”, “believes”, “estimates”, “targets”, “plans”, “outlook” “guidance” or similar expressions.

There are numerous risks, uncertainties and other factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this presentation and which could affect our ability to achieve our stated targets. The important factors that could cause such differences include, among others: business risks associated with the volatile global economic environment and political conditions; costs associated with compliance activities; market acceptance of new products and services; changes in governmental regulations and currency exchange rates; estimates of future warranty claims and expenses and sufficiency of accruals; and other such factors as may be discussed from time to time in Landis+Gyr Group AG filings with the SIX Swiss Exchange. Although Landis+Gyr Group AG believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.